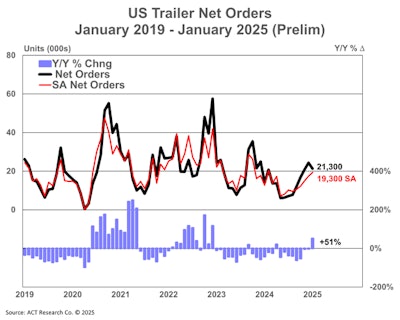

ACT Research’s preliminary data shows net trailer orders fell by approximately 3,100 units from December 2024 to January 2025, landing at 21,300 units. Despite the decline, the data represents a 51% increase year-over-year.

“Though past the traditional peak, we’re still in a period of ‘strong order’ intake,” said Jennifer McNealy, director CV market research & publications, at ACT Research. The slight drop from December was expected and doesn’t indicate a major decline.

It’s not surprising that orders exceeded January 2024 levels, McNealy said, given the slow demand in 2023 and early 2024.

ACT Research

ACT Research

However, despite recent improvements, McNealy cautioned that ACT expects continued weakness in trailer demand.

McNealy pointed to factors that suggest uncertainty in the market, such as weak fundamentals in the for-hire truck market, low used truck values reducing incentive for new trailer purchases, high dealer inventories limiting demand, and high interest rates discouraging new investments.

[RELATED: Trailer orders grow in December, but 2024 total drops amid weak market]

January marks the third consecutive month of annual growth, according to FTR Transportation Intelligence.

FTR reported that total trailer net orders for the 2025 order season (September 2024 to January 2025) are down 21% year-over-year at 98,926 units — an average of 19,785 units per month, despite a healthy level of orders in the beginning of the year.

Fleet purchasing decisions favor power units over trailers, largely due to the upcoming EPA 2027 NOx regulations, Dan Moyer, senior analyst, commercial vehicles, at FTR stated.

During the 2025 order season so far, Moyer noted that North American Class 8 net orders are up 4% year-over-year, whereas U.S. trailer net orders are down 21%. Trailer OEMs have also scaled back production, he said, and further cuts may be needed if demand remain low.

Tariffs pose a major risk, Moyer said. He pointed to the 25% tariffs on steel and aluminum imports set to take effect in March, in addition to the existing 10% tariff on Chinese imports and the potential reimposition of 25% tariffs on Canadian and Mexican imports.

These measures will likely increase material costs, pressure margins, and strain supply chains, he said.

The impact will be felt not only on fully assembled imported trailers, but also on domestically produced units that rely on imported materials and components, Moyer added. “Expect market volatility as OEMs try to adapt to uncertainty over scope and timing of tariff impacts.”

[RELATED: Tariff plans could disrupt truck production and pre-buying activity]

FTR’s data indicated production remains historically low. Total trailer production increased 2% month-over-month in January to 12,042 units but remained 35% lower than the previous year –46% below the seven-year January average– and was the second-lowest monthly output since 2010. As net orders outpaced production, backlogs rose by 12,210 units, pushing the backlog-to-build ratio up to 9.7 months, the highest since February 2023.

ACT Research noted that trailer demand strength will depend on sustained order activity beyond early 2025.

“An order uptick showcasing demand, or the lack thereof, depends not just on the first few months of the new order cycle, but on order volumes through Q1 2025 and beyond,” McNealy said.

Used truck market shows mixed signals

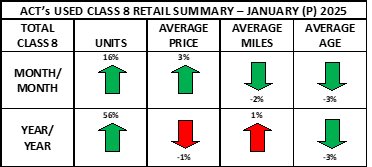

ACT Research’s preliminary data shows that January Class 8 same dealer used truck retail sales volumes increased 16% month-over-month.

ACT Research

ACT Research

The used truck retail market started 2025 strong, outperforming typical seasonality, which called for a decrease of 11% month-over-month, said Steve Tam, vice president at ACT Research.

However, auction activity dropped sharply, down 59% from December, while wholesale transactions surged 22% year-over-year. Combined sales declined 31% month-over-month.

Declining new truck sales during Q4 2024 is a possible factor behind weaker used truck sales in January, Tam said. Weaker conditions, along with economic and political uncertainties, may also be potential causes.