The trucking market’s rebound has been slower than expected, with stagnant freight prices and a low flow of carrier exits slowing down the rebound, according to Motive’s holiday outlook report examining the state of freight entering the peak season and early 2025.

The report, authored by Hamish Woodrow, head of strategic analytics at Motive, aggregated insights from FMCSA, U.S. Census, DOT, and its network of drivers. It forecasts moderate growth to return in the first quarter and long-term growth trends of 5.7% year-over-year to return by the end of next year. “With the oversupply of carriers now gone, the market looks more like it did before 2020, drawing closer to more traditional, cynical trends,” Woodrow said.

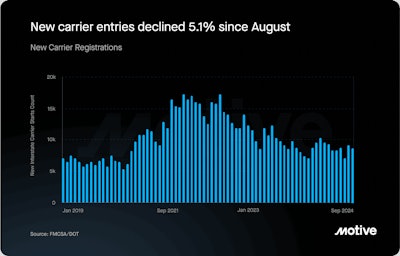

Carrier exits remained stable in September, with about 1,300 operators closing for the third consecutive month. Low trucking rates are challenging for small businesses, making it hard for many to remain viable. Meanwhile, new carrier entries have decreased by 5.1% since August, though 7,800 new carriers still joined the market. Despite being down 10% compared to last year, new entries remain 38% above pre-pandemic levels in 2019.

Motive

Motive

While strong consumer demand over the holiday season will likely fuel positive freight growth, the report forecasts new carrier entries may briefly dip as many await the new year to launch operations. By 2025, rising freight rates are expected to stabilize the market, which will likely favor established trucking companies. Newer operators, particularly in large states like California and Texas, may face higher turnover as rising costs test their strength.

Increased safety risk and fraud

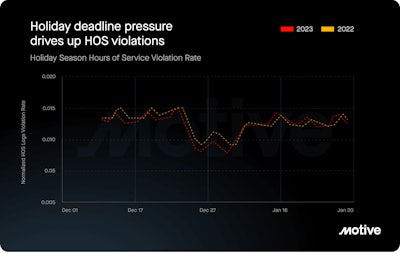

As the holiday season approaches, the report warned that increased shipping activity and the push to guarantee on-time delivery will bring increased risk.

Accident and weather risks particularly tend to be high during the holidays, with a 10% increase in speeding events before Christmas, resulting in a 32% spike in crashes on Christmas Day when compared to the rest of December. Dangerous weather also plays a critical role, with 65.5% of Christmas Day crashes occurring on wet, snowy, or icy roads.

[RELATED: Motive introduces new emergency response feature for commercial drivers]

Motive

Motive

Motive’s data show that 47% of all collisions happen after dark, while hours-of-service violations peak during the holiday season as well. Violations then decline in the two weeks after the rush, highlighting the season's intensity.

At the same time, the hurricane season has also left behind prevalent damage, causing drivers being rerouted, delayed shipments, and a spike in operating costs.

Similarly, the risk of theft and fraud is expected to be higher during the season, according to the report. In the first half of 2025, cargo theft increased 49%, which will likely be intensified during the holidays. Holiday theft trends from the past five years show an average loss of $121,473 per theft.

Fraud, particularly fuel card theft, is an increasing challenge for fleets, with industry leaders estimating that 19% of current fleet spend is on fraud or theft.

Surge in nearshoring

With challenges such as long-term bottlenecks and extreme weather disrupting critical shopping periods, Woodrow pointed out that retailers are shifting from the traditional low-inventory, just-in-time restocking model. Instead, they’re restocking earlier and garnering extra inventory to buffer against unpredictable disruptions, as seen by a 19.7% year-over-year increase in Chinese imports by mid-summer.

The report indicated that retailers are increasingly nearshoring operations to Mexico to diversify supply chains. Cross-border imports by trucks coming through the Laredo port had a spike a of more than 24% in August, indicating a record high at the crossing.

By early next year, Abhishek Gupta, vice president of product management at Motive, said that retailers will continue moving away from just-in-time inventory strategies, opting for higher inventory-to-sales ratios, which are predicted to rise above 1.3 by December 2024 and remain elevated throughout 2025.

Motive expects a typical slowdown in restocking in January 2025, though they predict a bump in restocking toward the end of Q1 next year, driven by nearshoring and increased trade at the Laredo border crossing, Gupta said.

“Retailers seem to be planning their inventory strategies further ahead than they had been in the last two years,” Gupta said. While this has been likely done in part to avoid anticipated future freight rates, it can also be a sign that retailers are starting to plan for less predictable disruptions such as natural disasters, labor disputes at ports, and geopolitical conflicts.